October 20, 2014

Greetings!

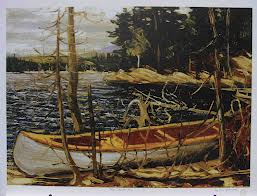

I love the fall foliage. Yesterday I left early and drove to Algonquin Park (in Ontario Canada). It was an amazing day. Beautiful scenery. Quiet. Solitude. Group of 7 Art, etc. It’s amazing to me how many people who live in Southern Ontario have never been there. It can be done in a day. Leave early. Return late with a completely different perspective on the world.

I love the fall foliage. Yesterday I left early and drove to Algonquin Park (in Ontario Canada). It was an amazing day. Beautiful scenery. Quiet. Solitude. Group of 7 Art, etc. It’s amazing to me how many people who live in Southern Ontario have never been there. It can be done in a day. Leave early. Return late with a completely different perspective on the world.

Although I have been there many times, this time I went to the park logging museum and learned a bit about the history of the park. I hadn’t fully appreciated it’s commercial roots and how it was home to the Canadian logging industry. In a previous century men manually cleared the trees, brought them to the river where they were transported downstream – their eventual destination – England. Why England?

The answer is that during England’s war with France, Napoleon manged to “cut off” England’s supply to the lumber that was needed to build British ships. To be more precise:

Napoleon Bonaparte of France, which was at war with Britain, imposed a naval blockade on timbers coming from the Baltic Sea to Britain. This resulted in a need for the British to seek elsewhere to harvest their timbers, and they looked to British North America. They specifically looked at the colonies of Nova Scotia, New Brunswick and Canada as its source of Pine timber to maintain the ships of the Royal Navy. (1808)

The lumber industry in Algonquin Park was a very significant part of the Canadian economy. It’s fascinating that a brilliant tactical decision, by a brilliant French General, in the early 1800s contributed to the development of the Canadian economy and how I spent part of my weekend.

My point is that “far away” events can have local consequences. “Far away” events can have unexpected consequences. Who would have imagined that the events caused by 911 could have set off the chain of events that they did. Who would have imagined that the events caused by 911 (FBAR enforcement, requirement of a passport to enter the United States, etc.) could have contributed to the difficulties of Americans abroad today?

To be sure, U.S. citizenship-based taxation has existed (in theory but not in practice) since the Civil War. It has been the events since 911 that have converted the theory of citizenship-based taxation into the “prison of citizenship-based taxation” that it is today.

U.S. citizens abroad are living under siege. A wonderful description of this comes from Jackie Bugnion in her submission to the House Ways and Means Committee on Tax Reform. She said:

In 1776, the United States declared independence because the mother country on the other side of the ocean was imposing taxes on the colonies for the benefit of England. Resentment started when Britain tried to enforce the Navigation Act after 1763. Resentment increased with the Stamp Act in 1765, a way for Britain to tax the colonies. The British Tea Act of 1773 led to the Tea Party and we all know the outcome – the American Revolution and independence crying out “no taxation without representation”.

Today, the estimated 7 million Americans resident abroad, of whom the majority are long-term overseas residents in high tax OECD countries, face a comparable situation. Their representation in Congress is non-existent in reality. Americans abroad amount to only 1 to 2% of the votes in any particular state; Congressmen and Senators have ignored their tax issues. The unjustified myth that Americans abroad are wealthy and disloyal restricts a rational approach to the problems because of political image issues.

Citizenship-based taxation (CBT) has existed ever since the federal income tax was adopted. Despite CBT being an anomaly involving double taxation, taxation of phantom gains and explicit tax code discrimination, it was grudgingly tolerated by Americans abroad because it was essentially voluntary, most often involved little tax or no U.S. tax liability and basically was not enforced. In particular, the FBAR filing requirement was so obscure that even the big four accounting firms were not aware of the filing obligation dating from 1970 and failed to inform Americans abroad of the need to file the FBAR.

Since 2001, a series of legislative events have radically changed the situation:

In 2001, the Patriot Act made anything foreign suspect, including Americans residing overseas.

In 2004, Congress, under the Jobs Act, drastically increased the FBAR civil and criminal penalties to confiscatory levels, creating a disguised form of taxation on assets held overseas.

In 2006 administration of the FBAR reports was transferred to the IRS for enforcement.

In 2006 the Tax Increase Prevention and Reconciliation Act (TIPRA) extended the Bush tax cuts and included a compensatory revenue raising provision that reduced the benefit of the foreign earned income exclusion, limited the foreign housing allowance and pushed Americans overseas into higher tax brackets, thereby increasing U.S. tax liabilities for many Americans abroad.

In 2008 the law relating to renunciation of U.S. citizenship was revised under Section 877A and introduced an Exit Tax on wealthy individuals (defined as “covered”). The law also provided that Americans who inherit from estates of former “covered” U.S. citizens are subject to U.S.

inheritance tax with no exclusion. This outrageous discriminatory provision aims to discourage renunciation of citizenship, but in fact penalizes children of former U.S. citizens for an act they did not commit. In practice, it encourages the children to also renounce their U.S. citizenship.In 2009 the IRS launched its initiative against tax evasion linked to foreign assets through the Overseas Voluntary Disclosure Programs and a threatening public relations campaign. While it justifiably targeted U.S. resident tax evaders, it simultaneously trapped Americans abroad who necessarily have foreign assets. The IRS’s one size fits all policy and bait and switch tactics led to abuses of Americans abroad which inspired sharp criticism from the National Taxpayer Advocate.

In 2010 FATCA was slipped into the HIRE bill with no debate in Congress and no cost/benefit analysis. FATCA aims to provide the door that closes the fiscal trap by requiring foreign financial institutions to report to the IRS on assets held overseas by U.S. persons. It effectively cuts off many Americans from foreign financial institutions which find it too onerous to maintain American clients. FATCA creates a barrier to free movement of capital and people.

In 2012 S.3457 proposed to grant the IRS the authority to have a U.S. passport cancelled or not issued if the IRS determined that the individual owed $50,000 or more U.S. tax.

In 2012 the Ex-patriot Act, S.3205, proposed to deny any “covered” expatriate re-entry into the United States, with retroactive effect for ten years prior to enactment of the law. The Reed

Amendment of the 1996 Illegal Immigration Reform and Immigrant Responsibility Act already

allows the United States to deny entry of former citizens into the United States.In 2013, S.268 was introduced; it compounds difficulties created by FATCA.

In 2013 the Senate Finance Committee included in its tax reform recommendations a provision which would grant the IRS authority to cancel a U.S. passport for tax collection purposes.

This stream of legislation and proposals categorizes Americans abroad as suspected criminals seeking to escape U.S. taxes. Congress has outdone George III and has turned the United States into a fiscal prison, including legislation which is deemed anti-constitutional under the Fifth Amendment1 and is contrary to Articles of the Universal Declaration of Human Rights.2

The foundation of the U.S. fiscal prison is citizenship-based taxation. Americans working and living abroad carry a ball and chain of dual taxation throughout their entire lives up to and including death.

Americans abroad already pay taxes in the country where they reside and receive governmental services.

The additional U.S. tax obligation creates inevitable incompatibilities and discrimination and even requires Americans abroad to break foreign exchange control laws to pay U.S. taxes.

A revolution among long-term overseas residents is now underway. Five years ago, Americans abroad never talked about renunciation of citizenship. Today, it is a common topic in the press and among the community abroad. For more and more individuals, renunciation is the only solution to an intolerable situation created by the U.S. imposing its laws beyond its borders. The United States is literally destroying the community of Americans abroad, which plays an essential role in representing U.S. interests and goodwill overseas. The United States is shooting itself in the foot.

While the absolute number of renunciations, currently around 2,000 a year, is insignificant compared to the average annual U.S. citizenship naturalizations of 680,000, renunciations have multiplied seven times over the last four years. So far we have seen only the tip of the iceberg if CBT remains in force.

Today’s situation leads to serious hidden prejudice for the United States. U.S. exports are far below where they should to be because citizenship-based discourages U.S. companies from deploying U.S. citizens overseas to sell U.S. products; the law makes them too expensive. U.S. tax law and FATCA create insurmountable barriers for small and medium-sized companies to establish beachheads abroad to develop exports. The loss represents millions of U.S. jobs, hundreds of billions of dollars of exports, billions of dollars of U.S. tax revenue, and an unsustainable trade and budget deficit. Americans married to a foreign spouse, who represent about a third of the Americans resident abroad, now hesitate to register their children born abroad with the U.S. Embassy. The hot thing among young adults in their twenties is to renounce U.S. citizenship; they are aware of the impossible web of U.S. regulations that restrict job opportunities and personal freedom. Pushing away the young generation of Americans abroad is an immense loss to the United States. In prior generations, many highly educated multi-lingual American children returned to the United States, founded companies and created jobs in the U.S.

Adopting RBT will stop this revolution immediately. RBT law needs to be drafted in the spirit to allow free movement of individuals to leave and return to the United States, to reinforce the competitiveness of Americans and the United States overseas, to provide a simple, non-penalizing transition to RBT for the community of Americans already overseas, to ensure that Americans abroad are not subject to FATCA and FBAR, to adapt existing bilateral tax treaties and enter into new tax treaties so that withholding tax rates on U.S. source income are reasonable and to ensure that Americans abroad who have the majority of their assets in the United States (retirement funds, pension funds, real estate) are not disadvantaged under RBT with regard to either income or estate taxes.

I thank you for the opportunity to comment and hold high hopes that your bi-partisan efforts will lead to the constructive tax reform so necessary for Americans residing abroad.

Sincerely yours,

Jacqueline Bugnion

Jackie Bugnion’s notes that the United States of America has created a fiscal prison for those Americans who leave the United States and that:

1. The foundation of the U.S. fiscal prison is citizenship-based taxation. Americans working and living abroad carry a ball and chain of dual taxation throughout their entire lives up to and including death.

2. A revolution among long-term overseas residents is now underway. Five years ago, Americans abroad never talked about renunciation of citizenship. Today, it is a common topic in the press and among the community abroad. For more and more individuals, renunciation is the only solution to an intolerable situation created by the U.S. imposing its laws beyond its borders. The United States is literally destroying the community of Americans abroad, which plays an essential role in representing U.S. interests and goodwill overseas. The United States is shooting itself in the foot.

Jackie Bugnion has got it right! Jackie Bugnion has got it exactly right!

To put it simply, to be a U.S. citizen living outside the United States is to live in a “fiscal prison”.

Of course, to be imprisoned, one must be identified as a U.S. citizen.

FATCA is the tool to identify those – who according to U.S. law – are designated as U.S. citizens.

Renunciations of U.S. citizenship are increasing. The Government of the United States – the Obama administration – has responded in two ways:

1. By raising the renunciation fee to $2350; and (even more disturbingly)

2. By restricting the availability of appointments to renounce U.S. citizenship.

I have permission to share the following message with you:

I am having a terrible time getting an appointment with the US Consulate in Toronto. I am going to contact John Cornyn, senior Republican senator from Texas re. this matter. He apparently voted against FATCA when this odious law was brought before the US senate. Maybe if all American renunciants who are caught in the IRS’s web write to “their” senators it would be more beneficial than complaining about this unjust law. We have to help ourselves and be pro-active against FATCA (and the US consulates who are trying within the perameters of US law) to hang onto us. As of Friday, October 10, the consulate was not even taking appointments for the summer session until after November 1. I have to re-submit ALL of my paperwork in order to re-apply for an appointment sometime during the summer of 2015. There has to be an easier way to renounce–maybe a mass renunciation, as the US does when they trap people into becoming US citizens as they take the oath of allegiance en masse. Please print this information on your website.

In 1963, President John F. Kennedy speaking at the Berlin Wall said:

“Freedom has many difficulties and democracy is not perfect, but we have never had to put up a wall to keep our people in to prevent them from leaving us.”

Watch President Kennedy’s speech.

Our FATCA Lawsuit

In August of 2014 the Alliance For The Defence of Canadian Sovereignty brought a lawsuit against the Government of Canada, to prevent them from collaborating with the Obama administration, by signing and implementing a FATCA IGA in Canada. Various members of the tax and accounting community have criticized this initiative claiming that:

1. If our lawsuit is successful that we will somehow damage Canada; and/or

2. FATCA is a U.S. law (funny, I thought that was part of the problem) and that because of this. the success of our lawsuit is irrelevant.

These sentiments, were captured and expressed in the following comment on this blog:

I have to wonder about this lawsuit. Just saying…its not likely to make the US repeal FATCA, so a ‘win’ in this suit would what? Nullify the Canadian IGA? Wouldnt that strip us of the benefits of the IGA and then force banks to report every piddley little thing they see to the IRS?

Dont get me wrong, I’m a big fan of the Isaac Brock Society’s work with regards to FATCA (in fact I just renounced today). I just question what the possible benefit to Canadian dual citizens would be if this case is won. I really doubt a win would mean that Canada gets out of FATCA.

Canada’s IGA is the mechanism to make FATCA legal and mandatory for all financial institutions in Canada. Canada’s IGA is for the purpose of making discrimination against one group of people – based on the immutable characteristic of place of birth – mandatory. FATCA is the U.S. tool to enforce the “fiscal prison” of “citizenship-based taxation” on people residing outside the borders of the United States. FATCA is the tool to enforce the “fiscal prison” of “citizenship-based taxation” on ANY person in the world that the U.S. chooses to define as a U.S. citizen.

Yet there are many people in the world, who really don’t understand, or say they don’t, what is the great issue between a FATCA and a non-FATCA world. There are those who believe that FATCA provides benefits to Canada, to Canadians and to the world. Let them see what it’s like to have the circumstances of their birth determine the outcome of their life! Let them be hunted in a FATCA world.

In my next post I intend to address the sentiments in the above comment.

If you get a chance, I really recommend a trip to Algonquin Park. Algonquin Park is (at least mentally) a “FATCA Free Zone”. Berlin is a great place to visit too!

If you get a chance, I really recommend a trip to Algonquin Park. Algonquin Park is (at least mentally) a “FATCA Free Zone”. Berlin is a great place to visit too!

Ich bin auch ein Berliner.

Keep the faith!

John F. Kennedy’s words are haunting. Listen to them over and over. Listen to many of his words over and over. If he only knew the wall being built around the USA.

It is to weep.

LikeLike

…and thanks for sharing with us your FATCA-Free Zone. Those zones are all around us to help us renew our spirits and our courage and to be able to KEEP THE FAITH.

Excellent post with all you tied together.

LikeLike

We’ve just finished our Autumn colour roundup here in Alberta with another day trip into the mountains. The golds of the Aspens and Poplars are gone but the Tamarack Larch are peaking. I would love someday to see the flaming oranges and reds of Ontario and Quebec. Thank you, John, for the FATCA-FREE break to Algonquin Park and the comprehensive roundup of CBT consequences.

LikeLike

[…] John says in his post: […]

LikeLike

“A revolution among long-term overseas residents is now underway.”

This appears to be a semblance of “A Declaration of Grievances and Resolves.” Maybe it could be more formal.

LikeLike

Great post John. At some point it would be great to see a geographical breakdown of where the ADCS donations have originated from. I am sure the vast majority are Canadian as that is the location of the lawsuit, but I hope there is a significant minority from other countries.

The lawsuit may be in Canada, but this is significant for ALL US persons outside of the United States. If the lawsuit succeeds in Canada, other countries will think twice about the validity of the IGAs that they signed. It would encourage others to sue their own governments with similar arguments. Unfortunately, Canada is probably the only country that has significant mass of US persons to challenge this beast on home soil, but the rest of the world is watching closely.

Best.

LikeLike